Should You Refinance Your Mortgage? Here’s How a Mortgage Refinance Calculator Helps You Know (Without the Headaches)

Table of Contents

You’re staring at your monthly mortgage statement again. That number feels wrong. Too high. You know what I’m talking about: refinancing, ads with catchy slogans inviting you to refinance to save on interest rates, or that neighbor who simply won’t shut up about how much money they’re saving through refinancing their home.

The thing is, refinancing isn’t a kind of magical thing that can work for everybody financially. Sometimes it makes brilliant sense. Other times? You’d literally lose money.

So how do you know which camp you’re in? That’s where a mortgage refinance calculator becomes your new best friend.

Calculators sound boring. Math sounds worse. I’ll show you exactly how to figure out whether refinancing could save you thousands of dollars or whether you should keep scrolling past those refinance offers cluttering your inbox.

What Actually Is a Mortgage Refinance Calculator (And Why Should You Care)?

Strip away the jargon, and a mortgage refinance calculator is just a tool that does some heavy lifting for you. It will look at your existing mortgage terms, compare those terms with new loan terms, and then advise you on what the actual financial implications would be.

It’s like having a GPS on your mortgage. You wouldn’t get into your car and drive from here to California without finding out if you are actually going the right way, right? Same logic.

The calculator crunches numbers across several key areas:

Your loan situation now: what you owe, what rate you’re paying, how many years you have left

New terms on possible new loans: the rate of interest you could obtain, the term of any new loans you’re thinking of taking out

The break-even point: this is the big one. How long until your savings from the lower payment actually exceed the costs of refinancing?

That last piece is what most people miss. Refinancing costs money upfront. Closing costs, application fees, appraisal charges, they add up fast, often between 2% to 5% of your loan amount. A mortgage refinance calculator shows you exactly when you’ll recover those costs and start actually saving money.

When Does Refinancing Make Sense? (Real Talk)

Before you even open a mortgage refinance calculator, let’s talk about the scenarios where refinancing usually makes sense.

Interest rates dropped significantly since you bought your home. The classic rule of thumb says a 1% drop makes refinancing worth considering. But that’s not a hard rule. Even a 0.5% drop might make sense depending on your loan size and how long you plan to stay in the house.

Your credit score improved. Maybe you had some ding on your credit when you first bought. If you’ve spent the past few years being responsible (paying bills on time, keeping credit card balances low), your score probably jumped. Better credit score = better interest rates = potential savings.

You want to change your loan term. Individuals also choose to refinance their 30-year mortgage to a 15-year mortgage to allow them to build equity faster and pay less in interest payments. Others do the opposite, extending the term to lower monthly payments. Neither approach is “right” or “wrong”, it depends on your specific situation.

You’re drowning in an adjustable-rate mortgage. If your ARM is about to reset to a higher rate, you can avoid future payment shocks by refinancing to a fixed-rate mortgage.

You need to tap your home equity. Life happens. Maybe you need cash for home improvements, consolidating high-interest debt, or covering unexpected expenses. A cash-out refinance enables you to access a loan against your house equity. (Just be smart about this, your house isn’t an ATM.)

How to Use a Mortgage Refinance Calculator (The Simple Version)

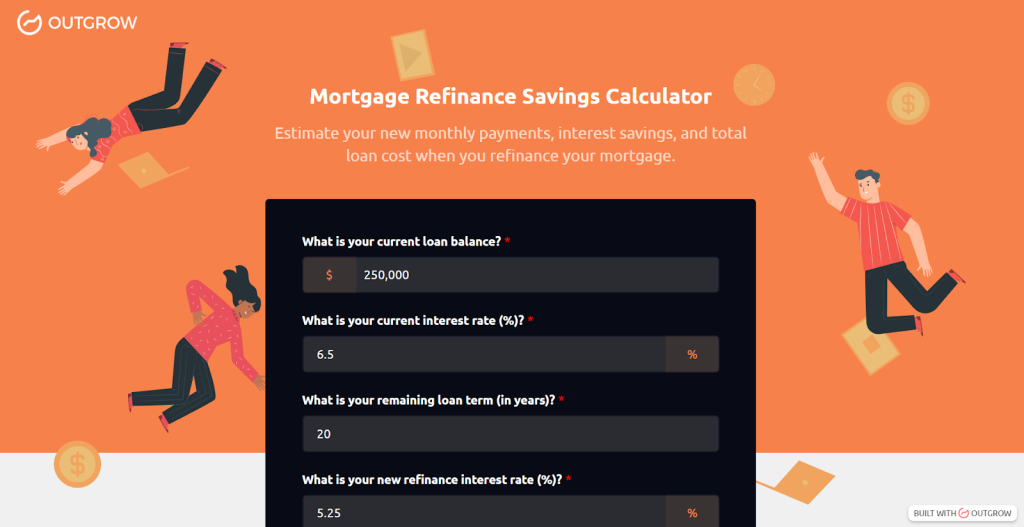

Alright, let’s get practical. You’ve decided to test the waters. Here’s what you’ll actually do with a mortgage refinance calculator.

Gather your current mortgage info. You need your current loan balance, interest rate, and remaining loan term. Your most recent mortgage statement has all this. If you can’t find it, your lender’s website definitely has it.

Find out the closing costs. Ask each lender for an estimate of total closing costs. These vary wildly between lenders, so don’t assume they’re all the same.

Plug everything into the calculator. Most mortgage refinance calculators ask for the same basic inputs. Current loan details on one side, potential new loan details on the other.

Check the results. It will also give you a bunch of important numbers: what your new monthly payment will be, how much total interest you’ll pay over the life of the loan, where your break-even point is, and how much you’ll save in total.

Here’s an example that makes this concrete:

Let’s say you have $250,000 left on your mortgage at 6.5% interest with 25 years remaining. Your monthly payment is around $1,686. You get quoted 5.25% on a new 25-year loan with $5,000 in closing costs.

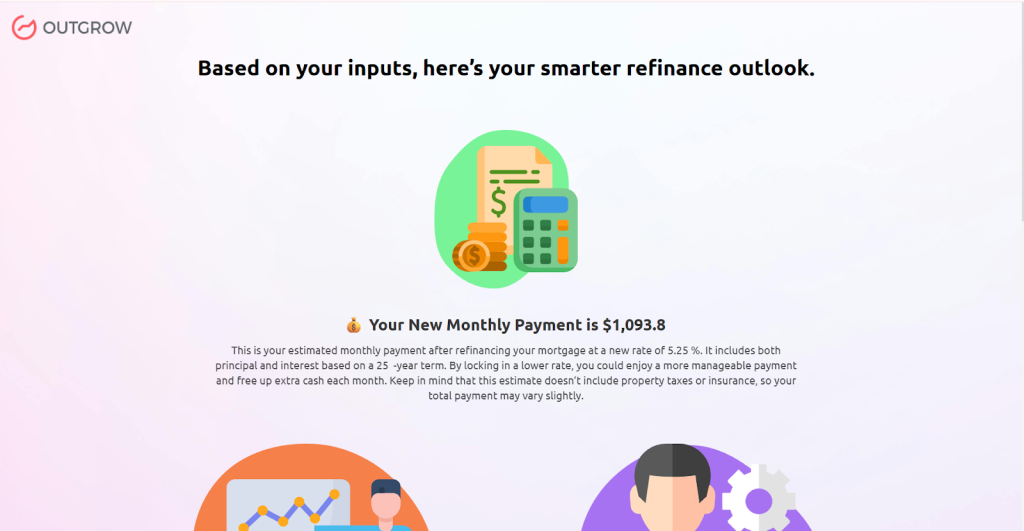

Punch those numbers into a mortgage refinance calculator, and you’d see:

- New monthly payment: $1,515

- Monthly savings: $171

- Break-even point: 29 months (that’s when your $5,000 in closing costs equals your accumulated monthly savings)

- Total interest savings over the loan: around $43,000

After 29 months, you’d be saving $171 every single month. If you plan to stay in the house for at least three years, this refinance is a slam dunk.

The Hidden Costs Nobody Talks About

Here’s where most articles stop. They give you the rosy picture and send you on your way. But there are some sneaky considerations that a basic mortgage refinance calculator might not capture.

Prepayment penalties. Some mortgages charge you for paying off the loan early. Check your original mortgage documents. If you have a prepayment penalty, factor that into your costs.

Resetting the clock on interest. When you refinance, you start fresh with a new mortgage. Even if the repayment term is the same when you refinance, the first years will have more interest associated with them because of mortgage amortization. The mortgage refinance calculator adjusts for this in the total interest calculation, but know why that number may look different from what you expected.

PMI considerations. If you have not put down at least a 20%, you could be paying private mortgage insurance. You can remove this when you refinance if you have gained enough equity. If you’re also pursuing a cash-out refinance that results in your home having less than a 20% equity position, you could have to pay PMI again.

Tax implications. The interest paid on mortgages can be deducted from taxes. If your new loan has significantly less interest, your tax deduction goes down. For most people, the savings from a lower interest rate far outweigh the reduced tax deduction, but it’s something to consider, especially if you’re in a high tax bracket.

Opportunity cost of closing costs. That $5,000 you’re spending on closing costs could be invested elsewhere. Could it earn better returns in the stock market over the same period? Maybe, maybe not. A comprehensive mortgage refinance calculator can help you model different scenarios.

Refinancing Mistakes to Avoid (Learn from Other People’s Screw-Ups)

I’ve seen people make some facepalm-worthy mistakes with refinancing. Learn from their pain.

Refinancing too often. Every time you refinance, you pay closing costs. Some people chase every tiny rate drop and end up paying more in fees than they save in interest. Use a mortgage refinance calculator to make sure the savings actually justify the costs each time.

Ignoring the break-even point. If you’re planning to move in two years, and your break-even point is three years, refinancing will cost you money. Period.

Falling for teaser rates. Of course, some lenders will advertise an amazingly low rate with a catch: you might be required to pay points in advance. If you’re using a mortgage refinance calculator, be sure you’re making an “apples to apples” comparison when comparing various offers.

Not shopping around. Lender fees and interest rates vary wildly. The difference between lenders can easily be thousands of dollars. Check at least three lenders before making a decision.

Extending your loan term without thinking it through. Of course, refinancing from a 30-year loan with 20 years left on it to a new 30-year loan may decrease your monthly payments. But you’ll be in debt for an extra 10 years and pay way more interest. A mortgage refinance calculator will show you the total cost difference.

Beyond the Numbers: Life Factors That Matter

Calculators are great, but they don’t know your life. Here are some personal factors to weigh.

How long are you staying in the house? This is the single biggest factor. If you’re moving soon, refinancing rarely makes sense because you won’t hit the break-even point.

Is your income stable? If you’re worried about job security, maybe don’t rush into refinancing. The closing costs could be money you need for an emergency fund instead.

What are your other financial goals? Sometimes the best use of money isn’t refinancing. Maybe you should be maxing out your 401(k), paying off credit card debt, or building savings instead.

How’s your stress level? Refinancing takes time and energy. Applications, documentation, appraisals, and underwriting. If you’re already overwhelmed, a few hundred dollars in monthly savings might not be worth the hassle right now.

How Outgrow’s Interactive Content Helps Your Decision

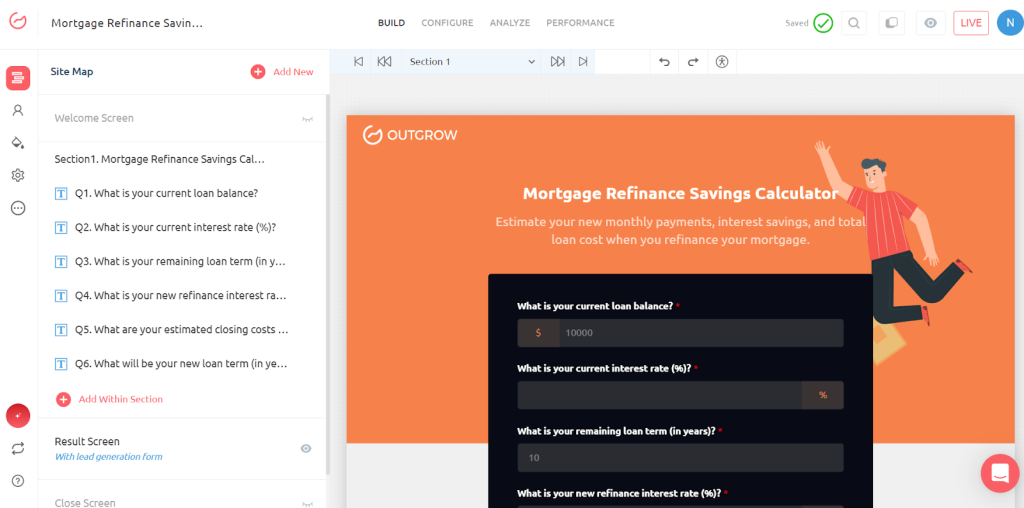

Static calculators give you numbers. Outgrow’s calculator builder provides an experience to better understand how those numbers would bring a change in your life.

Here’s the difference: when you use Outgrow’s interactive calculator, you’re not just inputting data into a black box. You get real-time visual feedback as you adjust different variables. Want to see how different interest rates affect your savings? Move the slider and watch numbers update in real time. Wonder what changing from a 30-year to a 15-year term would do? Click it on and watch the immediate results on your monthly payment and total interest.

Every scenario is immediately calculated, with visualizations that tell you exactly where your money is going. Break-even points are displayed on timelines. Savings are broken down month by month. Total interest comparisons are shown side by side.

This kind of interactive exploration helps you build confidence in your decision. You’re not just trusting that the calculator got the math right. You understand why the recommendation makes sense for your specific situation.

Try Outgrow’s Ready-to-Use Mortgage Refinance Calculator

You don’t need to be a financial expert or a math whiz to use Outgrow’s mortgage refinance calculator. The interface is designed for actual humans, not accountants.

The calculator walks you through exactly what information you need, with helpful tooltips explaining any terms you might not know. You won’t feel stupid asking what “loan origination fees” means because the tool anticipates your questions.

Input the data for your current mortgage, including the outstanding balance, your interest rate, the original mortgage term, and the monthly payments.

Then, enter the data for the refinance mortgage offer, including the new interest rate, the new loan term, and the closing costs estimate. Hit calculate, and boom, you get a personalized breakdown showing whether refinancing makes financial sense.

But here’s where Outgrow really shines: the results aren’t just numbers. You get actionable insights. The calculator tells you exactly how many months until you break even. It shows you total savings over different time periods. What you are currently doing versus what you would do when refinancing with easy-to-understand charts.

You can compare multiple refinance scenarios side by side, and even share your findings with a partner or financial advisor. No more scribbling calculations on napkins or trying to remember which scenario had which numbers.

The best part? Outgrow’s calculator is already built and tested. You can start using it right now, today, without building anything yourself. Just open it up and start getting answers.

Building Your Own Calculator with Outgrow

Maybe you’re a financial advisor who wants to offer clients a mortgage refinance calculator branded with your company logo. Or you’re a real estate professional who wants to add value for potential buyers. Or you run a financial education website and want to provide better tools for your audience.

Outgrow makes building your own custom calculator ridiculously simple. No coding required. Seriously, none.

The platform uses a drag-and-drop interface to select the inputs you desire (loan, rate, time, etc.) and determine how you want to present the results. Wish to make it match the company colors? Done. Want to collect email addresses from users in exchange for detailed reports? Built in. Want to integrate the calculator directly into your website? Copy and paste a single line of code.

You can do anything: modify the questions, add conditional logic (for instance, if the user chose a 15-year mortgage, why not have follow-up questions that are different from those if they chose a 30-year?), create your own result pages that explain the results the way you want them explained, and so on.

Outgrow’s calculator gives you a head start. Start with a proven mortgage refinance calculator that already has the right inputs and formulas, then tweak it to fit your needs. You can launch a professional calculator in hours, not weeks.

The platform handles all the technical stuff: mobile optimization, fast loading times, data security, and analytics tracking. You just focus on making the calculator useful for your specific audience.

How to Actually Get Started

Ready to see if refinancing makes sense for you? Here’s your action plan.

Spend 10 minutes with a mortgage refinance calculator. Use your real numbers. Be honest. Don’t fudge the numbers to make refinancing look better than it is.

If the calculator shows potential savings, check your credit score. You can get free credit reports from all three bureaus at annualcreditreport.com. Your score determines what rates you’ll qualify for.

Get actual quotes, not estimates. You want the real interest rate and real closing costs for your situation.

Run those real quotes through the mortgage refinance calculator. Now you’re working with facts, not estimates.

If the numbers still look good, start the application process with the best lender. Stay organized. Lenders will ask for pay stubs, tax returns, and bank statements; have them ready.

Lock in your rate when you’re satisfied. Interest rates fluctuate. Once you get a rate you’re happy with, lock it in.

Close the deal and start saving. Your first payment on the new loan won’t be due for about 45 days after closing. Take that month’s mortgage payment and stash it in savings or make an extra payment to build equity faster.

The Bottom Line on Refinancing

A mortgage refinance calculator is one of the simplest tools that can have the biggest impact on your finances. But it’s just a tool. The real decision comes down to your specific situation, your plans, and your goals.

Some people will save tens of thousands of dollars by refinancing. Others would waste money on closing costs for minimal benefit. The only way to know which category you’re in is to actually run the numbers.

Stop guessing. Stop relying on what your neighbor did or what some ad promised. Take 15 minutes, use a mortgage refinance calculator with your real information, and make a decision based on data.

Your future self will thank you. Or at least won’t curse you for making an expensive mistake.Ready to see what refinancing could do for your wallet? Try Outgrow’s Mortgage Refinance Calculator and get personalized results in minutes. No guesswork, no complicated spreadsheets, just clear answers about whether refinancing makes sense for you. Sign up for a free 7-day trial today and start building your customizable calculator.

Frequently Asked Questions

A mortgage refinance calculator compares your existing mortgage with potential new loan terms. You input your current loan details and new refinance quotes, and it shows you the monthly payment difference, total interest savings, and break-even point where your savings exceed closing costs.

Savings vary based on your interest rate reduction, loan balance, and how long you keep the new loan. For example, refinancing a $300,000 mortgage from 6% to 4.5% could save around $300 monthly and over $100,000 in total interest over 30 years, minus closing costs.

Refinance when rates are at least 0.5-1% lower than your current rate, your credit score has improved, or you want to switch loan types. You should plan to stay in your home long enough to pass the break-even point, typically 2-4 years.

Closing costs typically range from 2% to 5% of your loan amount, meaning $4,000 to $10,000 on a $200,000 mortgage. These include appraisal fees, loan origination fees, title insurance, and credit report fees.

The refinancing process typically takes 30 to 45 days from application to closing. This includes documentation gathering, home appraisal, underwriting review, and final approval. Some lenders offer expedited programs that can close in 15-20 days.

Sakshi is a digital marketing enthusiast passionate about connecting brands with audiences. With a background in content strategy and social media, she loves turning trends into actionable strategies. Outside of work, you’ll find her reading a book or hunting for the perfect cup of coffee.