Introduction

Table of Contents

Planning to buy something big? Down payment sitting in your future, trip you’ve been daydreaming about, emergency money you keep meaning to save, maybe a car? Deciding to save is easy. Knowing your actual monthly number – that’s where it gets tricky.

Here’s where a savings goal calculator helps. You tell it what you want, the price, and your deadline. It gives you the exact monthly amount. No more throwing random numbers at your savings account and hoping it works.

Most people just pick something – “I’ll save $300 a month sounds good” – without checking if it adds up. Three months before they need the cash, boom, they’re $7,000 short. The calculator stops this. Day one, you know if your plan works or needs tweaking.

What Is a Savings Goal Calculator?

Think of it like a GPS for your money. You punch in where you’re going (target amount), when you need to arrive (deadline), where you’re starting (current savings), and what you’re driving (expected returns). It maps the exact route.

What gets factored in:

- Your target dollar amount

- Deadline you’re working toward

- Money you’ve saved already

- Expected interest or returns

- Monthly contributions needed

- Interest earnings along the way

- Balance growth timeline

Fancier ones do more – inflation adjustments, variable contributions, early completion scenarios. Core function stays straightforward: turning “I want to save money” into “I need $487 per month.”

Why You Need a Financial Goal Calculator

Saving without numbers is throwing darts blindfolded. Maybe you hit something. Probably you don’t. A savings planning tool matters because:

- You get the actual monthly figure. Saving $32,000 for a wedding in 20 months? Zero returns means $1,600 monthly. Stick it in a 4% account? You need $1,555. That $45 matters less than knowing upfront if $1,555 fits your budget.

- Reality smacks you immediately. Want $70,000 in two years, making $55,000? The calculator says you need $2,800+ monthly. It literally can’t be done on your salary. Better finding out now than after wasting six months undersaving.

- You track if you’re on pace. Five months in, your monthly savings calculator says you should have $7,775 saved. Only got $5,900? Time to boost contributions or push back your timeline. Catching problems early means you can still fix them.

- Compound interest becomes real numbers. Save $650 monthly for eight years at zero – you’ve got $62,400. Same money at 6% returns? You’re looking at $76,900. That extra $14,500 came from your money working. The calculator quantifies this, so you hunt for better accounts.

- Different goals stay separate. Emergency fund calculator. Vacation calculator. Down payment calculator. Each tracks independently, so your $900 monthly gets split intentionally instead of dumped somewhere generic.

How Outgrow’s Interactive Content Helps Your Goals

Outgrow builds savings planner calculators that keep you engaged instead of showing math and disappearing.

Basic tools give you numbers. Outgrow creates experiences. Progress bars fill as you save. Charts show your balance climbing. Pop-up celebrations when you hit 25%, 50%, 75% of your target.

Conditional logic personalizes everything. Retirement savings calculator? You see questions about 401k matching and IRAs. Trip planning? Questions about booking windows pop up. The tool shifts based on what you’re doing.

Multiple goals in one spot. Track emergency fund, car purchase, and holiday shopping together. See all targets, timelines, and monthly requirements in one dashboard instead of three separate places.

The builder works for financial advisors, banks, and personal finance sites. Customize formulas, throw on your logo, and embed anywhere. Zero coding – just configure and go.

Lead capture happens automatically. People get their plan after entering an email. You’re collecting contacts actively working on finances – not random subscribers.

Try Outgrow’s Ready-to-Use Savings Goal Calculator

Before building yours, test the premade version here. Live right now – use your real numbers.

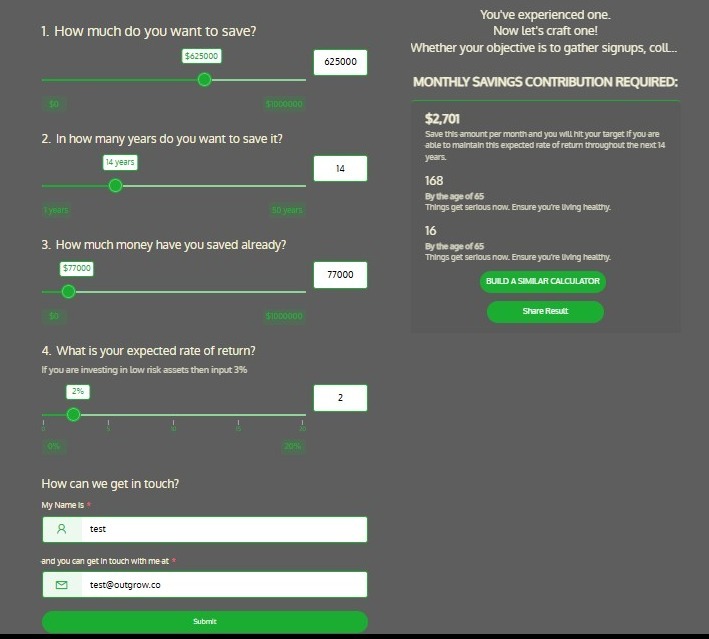

Four questions with sliders:

- How much do you want to save? – Slide from $0 to $1 million.

- In how many years do you want to save it? – Pick 1 to 50 years.

- How much money have you saved already? – Slide from $0 to $1 million.

- What is your expected rate of return? – Set 0% to 20% (suggests 3% for low-risk)

Takes 30 seconds. Slide to your numbers, and results appear instantly. Shows your monthly savings contribution needed.

Real example from the tool: Want $939,000 in 10 years? Got $108,000 saved? Expecting 4% returns? The monthly number is $5,283.

Can’t do $5,283? Slide to 12 years and watch it drop. Or reduce your target to $800,000. Testing takes seconds.

Why it works – compound interest bakes into every calculation. Your money doesn’t just pile up. It grows exponentially. At 4% over 10 years, a big chunk of your $939,000 comes from interest, not just contributions.

Advisors use this in client meetings. Banks stick it on account pages. Finance bloggers link from strategy posts. Works because it’s fast, clear, and gives you an action item.

Lead functionality is included, too. Users enter their email to save results. For businesses, that’s qualified leads planning major financial moves.

Building Your Own Calculator with Outgrow

Takes 20-30 minutes. Grab a template or use the free online survey tool.

Questions to ask:

- What you’re saving for

- Target amount

- Years until needed

- Already saved amount

- Expected annual returns

- Lump sums available

- Contribution frequency

Math is simple. Outgrow’s formula builder handles compound interest automatically. Reference your fields, the platform does calculations – monthly needs, interest earned, and final balance. Formats correctly without coding.

Design matters here. Add visual progress tracking. Include month-by-month balance charts. Milestone markers at 25%, 50%, 75%. People save better by watching progress happen.

Results page needs:

- Monthly amount required

- Total personal contributions

- Total interest earnings

- Month-by-month projections

- Completion date

- Tips for faster progress

Connect your systems. Link CRM and email platform. Someone finishes their goal, and contact info flows into your database. Trigger email sequences with progress reminders, tips, and product recommendations.

Industry Use Cases for Savings Goal Calculators

- Banks and Credit Unions drop calculators on savings pages. Someone comparing accounts sees what they’d earn toward goals. Captures new account leads while helping customers.

- Financial Advisors use them in discovery. Client mentions $1.8 million for retirement in 20 years? Pull up the calculator, plug in the current portfolio, and show the monthly investment needed. Vague goals become concrete instantly.

- Budgeting Apps integrate calculators into platforms. Users create targets in-app, track actual versus projections. Creates sticky experiences, keeping people subscribed.

- Employers offer website calculators as wellness benefits. Employees planning purchases or building emergency funds get clear guidance. Shows care about financial health beyond salary.

- Personal Finance Creators boost engagement and capture subscribers. Readers work through scenarios, get custom results, and subscribe to ongoing content.

Common Mistakes People Make

- Insane timelines. Want $28,000 in one year, earning $52,000? That’s $2,333 monthly – almost half your gross. Calculator exposes impossible goals immediately.

- Ignoring inflation. Saving $38,000 for a car three years out? At 3% inflation, a car costs $41,500 when you buy it. Build inflation in or come up short.

- Forgetting taxes on gains. That 9% return gets taxed. Taxable account nets may be 7% after taxes. Use realistic after-tax rates or projections miss badly.

- Assuming zero growth. Cash in a drawer loses purchasing power yearly. Basic savings at 3.5% offsets inflation and lowers monthly needs.

- Never updating for windfalls. Got a $4,200 bonus? Update the calculator with the new balance. Monthly requirement drops, or completion date jumps forward.

- One goal obsession. Saving everything for a trip while the emergency fund sits empty? Use multiple calculators to balance priorities. Don’t sacrifice security for fun.

Maximizing Calculator Effectiveness

Put calculators where people think about money. Savings strategy posts work great. Account product pages convert well. Financial planning newsletters capture engaged readers.

Build content around popular goals. “Save $18,000 for Your Wedding in 18 Months” links to a calculator. “Build $12,000 Emergency Fund in One Year” walks through the tool. Drives motivated traffic.

Social performs well with specifics. “Save $22,000 for Japan in 24 months – just $900 monthly.” Concrete numbers grab attention. Link for people to run their scenarios.

Emails work with timing. “Set 2026 Savings Goals” sent early January catches the New Year momentum. Monthly follow-ups keep people engaged.

Partner strategically. Mortgage brokers link to down payment calculators. Travel influencers link to vacation tools. Retirement advisors link to wealth-building calculators.

Reading Your Results

- The monthly savings required is your action number. Auto-transfer this exact amount every payday. Doesn’t fit the budget? Change timeline, lower target, or find extra income.

- Total personal contributions show what comes from paycheck versus returns. Understand the real cost from your pocket.

- Total interest earned demonstrates compound power. Long timelines with decent returns mean interest contributes 30-45% of the final balance. Justifies hunting for better yields.

- Month-by-month projection tracks progress. After four months should have X saved. Only at 75%? Boost now instead of discovering problems later.

- Completion date confirms when you hit the target at current rates. Overshoots the deadline? Need a higher monthly or bigger deposit.

Look at everything. Can’t afford the monthly? Extend the timeline or reduce the target. Side hustle bringing extra? The calculator shows how much faster you finish with an extra $175 monthly.

Staying Motivated to Reach Your Goal

Numbers won’t keep you saving monthly. Here’s how:

- Automate immediately: Set automatic transfers on payday. Money disappears before you see it. Can’t forget or spend what’s gone.

- Celebrate wins: Hit 25%? Celebrate small. Cross 50%? Share progress. Milestones sustain motivation through long hauls.

- Visuals everywhere: Saving for Hawaii? Calculator results as phone wallpaper. Saving for a truck? Photo on your desk. Connect the monthly number to the actual thing.

- Tell people: Share the goal with friends, post about it. Public accountability helps when motivation tanks in month seven.

- Review monthly: Compare actual to projections. Behind? Adjust something. Ahead? Increase the goal or speed the timeline.

Wrapping Up

A savings goal calculator transforms fuzzy dreams into hard monthly numbers. Know exactly what to save, when you arrive, and how compound interest speeds everything up.

The calculator won’t save for you. Discipline matters. But it kills guesswork and shows if goals make sense for the timeline and income.

For banks, advisors, and fintech companies, savings calculators capture leads while helping people. Free online survey tools make custom versions accessible without developers.

Pick a target. Run numbers. Save based on math instead of hopes. Hit financial goals faster with concrete plans.Sign up for a 7-day free trial today and reach your financial targets faster than ever before.

Frequently Asked Questions

A savings goal calculator can be explained as an application that computes how much money should be saved every month in order to attain the financial goal by a certain date. This calculator requires inputting the target sum, time period, as well as the actual and expected gains.

Calculators provide accurate predictions based on the entries. The entries should be based on realistic terms, which include true rates that are possible, true timeliness, and realistic amounts. The predictions made do not consider fluctuating markets.

Emergency fund savings: 6 to 12 months on average. Down payments: 2 to 5 years on average. Retirement savings: several decades. Generally, your savings should not take more than 20 to 30 percent of your monthly earnings unless you cut your expenses drastically.

Emergency fund: $300-500 monthly until 3-6 months’ expenses. Down payment (20% on $300K = $60K): About $1,000 monthly over 5 years. Vacation ($5,000): Around $400 monthly for a year. Calculators are customized for exact numbers.

Yes. Each goal has different timelines, risk tolerance, and priority. Emergency funds need safe liquid accounts. Retirement handles volatility. Vacation needs accessibility in 12 months. Separate calculators keep organized.

Muskan is a Marketing Analyst at Outgrow. She is working on multiple areas of marketing. On her days off though, she loves exploring new cafes, drinking coffee, and catching up with friends.

![7 Content Marketing Strategies You Need to Try ASAP [Infographics]](https://outgrow.co/blog/wp-content/uploads/2023/05/Blogs-min-1536x768-1-1-1.png)