Compound Interest and Investment Growth Calculator: Stop Guessing, Start Building Real Wealth

Table of Contents

Picture this: You deposit $5,000 and ignore it for ten years. You’re thinking maybe $7,000 when you check back. Nope. Try $13,000. That’s what happens when money makes money.

Most folks think growth works like a straight line. Drop $100 monthly, get back $100 times however many months pass. Completely wrong. Your compound interest and investment growth calculator reveals what actually happens – your returns start making their own returns. Numbers explode faster than you’d guess.

Why does someone retire at 55 while another works till 70? Usually just one thing: grasping this concept early. Time beats salary size. Always has. A proper compound interest and investment growth calculator proves this with your real numbers, not theory.

What Is a Compound Interest and Investment Growth Calculator?

Your financial fortune teller. Type your starting amount, monthly additions, expected returns, and timeline. The compound interest/investment growth calculator shows exactly where that money lands.

Here’s the kicker: Your interest earns interest. Put $1,000 at 8%, you’ve got $1,080 next year. Year two? That 8% hits $1,080, not your original grand. Year three works off an even bigger number. Lather, rinse, repeat till the snowball’s massive.

What feeds a compound interest/investment growth calculator:

• Your opening balance

• What you add each month

• Realistic yearly returns (stocks historically run 7-10%)

• How long you’re staying invested

• When returns get reinvested – monthly, quarterly, or yearly

Why You Need a Compound Interest and Investment Growth Calculator

Your gut stinks at predicting money growth. We all underestimate long-term compounding by ridiculous amounts. We also overestimate short bursts.

The math gets nuts quick. Calculate 30 years of monthly deposits at fluctuating returns in your head. Can’t do it. Spreadsheets? Most people botch the formulas. Your dedicated compound interest/investment growth calculator crunches everything automatically.

Test strategies instantly. Double monthly contributions? Start five years sooner? Take more risk for bigger returns? See results in seconds versus rebuilding spreadsheets forever.

Quit throwing away money. Tons of people park cash in savings accounts, earning 0.5,% when moderate risk gets 8%.

Kill the panic. Markets tank, and your brain screams SELL EVERYTHING. A calculator proves that staying invested beats panic moves every single time. Data trumps fear.

How Outgrow’s Interactive Content Helps Your Decision

Generic compound interest and investment growth calculator tools dump a number on you and bounce. Outgrow builds something different – an experience that makes those numbers click.

You get walked through one step at a time. No staring at ten empty boxes, wondering what goes where. Answer one question, get context.

Smart questions that adapt. College kids see different stuff than retirees. Starting from zero? Get guidance on opening contributions. Already got a portfolio? The calculator shows growth from your baseline.

Pictures beat tables. Charts color-code your contributions versus compound growth. Watch exactly when compound interest becomes the dominant force. See your wealth curve bend upward instead of staying flat.

No coding needed. Financial advisors, robo-advisors, fintech shops – they build custom calculators with drag-and-drop. You control formulas, slap on branding, and embed anywhere. Zero developers.

Lead capture built in. People get personalized results after dropping their email. You’re snagging qualified leads actively researching investment moves. Not random traffic – folks ready to act on their money.

Try Outgrow’s Ready-to-Use Compound Interest and Investment Growth Calculator

Before building custom, test Outgrow’s premade compound interest and investment growth calculator. Live right now, perfect for seeing how these work before customizing.

You’ll need:

• Starting amount you’ve got today

• Monthly additions you can swing

• Yearly return expectations – 7-8% works for conservative stock estimates

• Timeline before you need the cash

• How often compounding happens – usually monthly for investment accounts

Takes 60 seconds. Calculator processes everything and spits out your projected balance, total contributions, and growth. Results pop up immediately – no decoder ring needed.

Why this premade version rocks: Factors in real market behavior. Formulas account for monthly contributions compounding over time. Tax-advantaged accounts included. Complete picture, not basic multiplication.

Run your real numbers first. Then play scenarios. Started ten years ago? Double the monthly amount? Retire five years later? Seeing which factors actually move your retirement date matters.

Financial advisors stick this on their sites for investor leads. Robo-advisors show prospects automated investing power. Banks walk customers through during planning sessions. Works because it’s simple, accurate, and gives clear direction.

Building Your Own Calculator with Outgrow

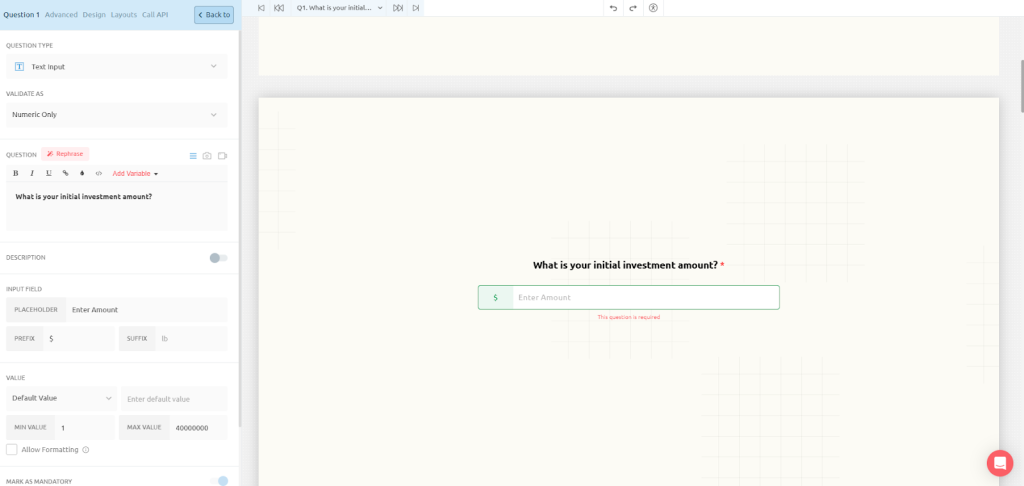

30-40 minutes to build a custom compound interest and investment growth calculator. Grab a template or start fresh.

Questions needed:

• Current investment balance

• Monthly contribution amount

• Expected returns – give realistic ranges

• Investment timeline

• Yearly contribution bumps for inflation

• Tax situation – pre-tax, post-tax, taxable

• Withdrawal age for retirement calculators

Setup is straightforward. Outgrow’s formula builder references answers and crunches math – like Excel, minus the headaches.

Pick a layout. Multi-step shows one question per screen, keeps focus. Single-page displays everything for quick comparison. Add context so people know what numbers to punch in.

The results page matters most. Show the final balance prominently. Break down total contributions versus compound interest growth. Throw in a chart showing wealth over time. Include what to do next based on the results.

Connect your systems. Link CRM, email, Slack – whatever you use. Someone finishes, and their data flows where needed. Fire follow-up emails, assign leads to advisors, and kick off nurture sequences.

Industry Use Cases for Compound Interest and Investment Growth Calculator

Financial Advisors stick calculators on sites to show the cost of waiting. Someone sees starting now versus five years out means $300k less at retirement. Boom – instant consultation booking.

Robo-Advisors demonstrate automated investing advantages. Compare dollar-cost averaging through ups and downs versus timing markets. Spoiler: consistency crushes timing. Way smoother than hitting people with account apps first.

Banks and Credit Unions help customers grasp CD laddering and high-yield savings growth. Shows the real dollar gap between the current 0.1% savings and switching to 4%.

Employer Benefits Teams convince employees to max out 401(k) matching. The calculator proves declining free employer match literally costs six figures over a career. Participation rates jump.

Investment Apps convert browsers to users, showing micro-investing impact. That $5 daily coffee becomes $190k over 30 years at 8%. Strong motivation to download.

Common Mistakes to Avoid

Crazy return assumptions. Using 12% yearly because stocks crushed it in one decade. Long-term average sits around 10% pre-inflation, 7-8% after. Bond-heavy? More like 4-6%. Use conservative numbers.

Skipping inflation. The calculator shows $2M at retirement. Sounds killer till you realize that’s worth maybe $1.2M in today’s dollars after 30 years of 2% inflation. Build inflation in or show real returns.

Ignoring fees. 1% yearly management fee looks tiny. Over 30 years? Cuts the final balance 25%. High-fee mutual funds at 1.5-2%? Even worse. Factor fees into the return rate.

Flat contribution forever. Keeping monthly adds flat forever? Unrealistic. Most folks earn more over time and should bump their contributions with raises. Build yearly increases of 2-3%.

Missing one-time events. Inheritance, home sale, business exit – windfalls change everything. Good calculators let you add lump sums at specific years.

Maximizing Calculator Effectiveness

Drop calculator where investors search. Blog posts on retirement planning, investment strategy articles, and financial independence content. Each article links to the tool.

Run ads straight to the calculator page. Someone Googling ‘retirement calculator’ wants answers, not marketing nonsense. Give the tool immediately. Lower cost per lead, better conversion.

Share findings on social. ’25-year-old investing $400/month hits $1M by 60′ gets clicks. People eat up real numbers for different ages. Creates shares and engagement.

Segment follow-up by results. Someone showing $3M at retirement needs different advice than someone struggling for $500k. Customize email sequences based on calculator outputs.

A/B test starting questions. Some engage better with the ‘retirement age goal’ first, while others prefer starting with current savings. Test both flows, keep the winner.

Reading Your Results

Final balance – your total at the timeline’s end. Combines everything: contributions, compound growth, the works.

Total contributions – what you actually put in. Opening amount plus all monthly adds over the years. Your money.

Investment growth – compound interest magic. Final balance minus contributions equals what markets gave you free. This number should excite you.

Crossover point – when growth beats your contributions. Early years? Your deposits dominate. Later years? Compound interest takes over as the main driver. Usually happens around year 15-20 for consistent savers.

Check the complete picture. Growing $100k to $250k over 10 years? Good. But if that needed $120k in contributions, you only earned $30k from investing. Check both numbers.

Wrapping Up

Your compound interest and investment growth calculator turns fuzzy investing concepts into concrete numbers you can act on. Build one with Outgrow or use existing calculators – just run the math before big financial moves.

A calculator won’t invest for you. Career path, risk tolerance, and financial goals still matter. But it kills the mathematical guesswork. You’ll know realistic outcomes when compound growth kicks in, and how strategies stack up.

Moreover, for financial advisors, investment platforms, and fintech companies, calculators work double duty, serving both as value-driven tools and powerful lead generation assets. Help users make smarter moves while capturing qualified leads ready to invest. Sign up for Outgrow’s 7-day free trial today and build your custom calculator.

Punch your numbers. Try scenarios. Make investment choices on facts instead of guesses. Future you will thank yourself for starting compound interest today.

Frequently Asked Questions

Calculates money growth when returns generate more returns over time. First, you punch in the starting balance, monthly contributions, expected return rate, and timeline. Then, the calculator projects your final balance by factoring in compound interest, so earnings are reinvested and, in turn, generate their own returns.

Overall, calculators provide estimates based on your inputs. However, accuracy depends on realistic assumptions, since actual returns fluctuate yearly, contributions may vary, and fees can significantly impact final results.

Absolutely. To begin with, simply drop in your current age, desired retirement age, existing savings, and monthly contribution capacity to get a clear picture of your retirement outlook. Then, the calculator instantly shows whether you’re on track or need adjustments. As a result, you’ll clearly see which factors matter most for reaching your targets.

With Outgrow, you can build custom, fully branded calculators with ease. Moreover, its smart logic adapts questions based on user responses, ensuring a more personalized and engaging experience. Instead of static forms, you create interactive experiences with visual results, personalized recommendations, and smooth lead capture.

In general, use 7–8% for diversified stock portfolios based on historical averages after inflation. However, the key is being honest about your risk tolerance and, more importantly, skipping unrealistic best-case scenarios to keep projections practical and reliable. Better to get pleasantly surprised by outperformance than disappointed by overly rosy projections that never happen.

Sakshi is a digital marketing enthusiast passionate about connecting brands with audiences. With a background in content strategy and social media, she loves turning trends into actionable strategies. Outside of work, you’ll find her reading a book or hunting for the perfect cup of coffee.

![[Infographic] How to Create Kickass Interactive Content](https://outgrow.co/blog/wp-content/uploads/2023/05/Blogs-min-1536x768-1-1-1.png)