Introduction

Table of Contents

You spend money getting customers. Marketing campaigns, sales commissions, ads, promotions. But here’s the thing, most businesses can’t actually answer: what’s each customer worth to you?

Not their last purchase. The whole relationship. That number changes everything about how much you should pay to get them and keep them around.

A customer lifetime value calculator gives you that number. Punch in average purchase amounts, buying frequency, your margins, and how long customers stick. Out comes the total value you’ll squeeze from each relationship.

Most companies just wing it. Monthly revenue tracking, call it done. The thing is, someone buying $40 once isn’t remotely the same as someone dropping $40 monthly for three years. One’s worth forty bucks. The other’s worth $1,440. Your marketing budget better reflects that gap.

The website calculator kills guessing. You know if dropping $200 to grab a customer makes sense or lights cash on fire, see which customer chunks actually matter, and spot when keeping people around pays better than chasing new ones.

What Is a Customer Lifetime Value Calculator?

Financial X-ray of your customer relationships. Shows what’s happening under the surface, past individual transactions.

What gets tracked:

- Average purchase value per transaction

- How many times do they buy yearly

- Gross margin per purchase

- How long do customers hang around

- What they’re worth annually

- Total lifetime value

- How retention shifts everything

Basic formula: Average Purchase Value × Purchase Frequency × Customer Lifespan × Gross Margin = CLV

Someone dropping $85 per buy, purchasing 4 times yearly, staying 3 years, 40% margin? That’s $408 lifetime value. Dead simple math with huge implications.

Fancier versions add retention curves, discount rates for future money, cohort breakdowns, and acquisition costs. Core job stays the same, though: turn customer behavior into a dollar figure you can actually work with.

Why Customer Lifetime Value Matters for Your Business

Running without knowing CLV is flying blind with a busted fuel gauge. Burning resources with zero clue if you’ll make the destination.

Why this number matters:

- Acquisition spending makes actual sense: CLV is $620. Spending $150 per customer? Profitable. Spending $720? Hemorrhaging cash on every new person. The calculator shows your ceiling before the budget gets torched.

- Retention gets prioritized right: Boost average lifespan from 2.5 years to 3.5 years? On a $180 annual customer value, that’s an extra $180 per person. Got 5,000 customers? Just found $900,000 in revenue by improving retention 40%.

- Customer segments are clear: Your $1,200 CLV people get premium support, exclusive stuff, loyalty perks. Your $95 CLV folks get basic service. Not being mean, allocating resources where they generate returns.

- Growth strategies clarify fast: Double the customer base or increase purchase frequency 50%? The CLV calculator shows which creates more value with your actual numbers. Kills strategy debates with real math.

- Margins show up visibly: Raise gross margin 35% to 42% on identical purchase patterns? Every customer just became 20% more valuable. Calculator quantifies margin improvements in customer value terms, not abstract percentages.

How Outgrow’s Interactive Tools Transform CLV Tracking

Regular CLV calculators spit a number and vanish. Outgrow builds interactive content, keeping you locked in with the metric.

- Past static calculations: Real-time visuals show how tweaking retention or purchase frequency moves total value. Slide retention up 6 months, watch CLV climb. Interactive scenarios beat spreadsheet fumbling.

- Logic branches for your business: Subscription model? Churn-specific questions pop. Retail? Seasonal purchase patterns appear. B2B? Contract values and renewals show up. Calculator morphs to what you need.

- Segment tracking is centralized: Track CLV for email subscribers versus social traffic. Compare product line A to the people to product line B. See geographic splits. Everything lives in one dashboard instead of scattered chaos.

- Built for specific use: E-commerce sites, SaaS platforms, agencies, and membership outfits customize formulas matching your revenue model. Slap on branding, embed anywhere, modify inputs. Zero developers needed.

- Lead generation runs automatically: Marketing agencies capture clients by analyzing their CLV. SaaS companies spot businesses ready for retention tools. Consultants collect contacts actively wrestling with customer value, qualified leads, not random traffic.

Try Outgrow’s Ready-to-Use CLV Calculator

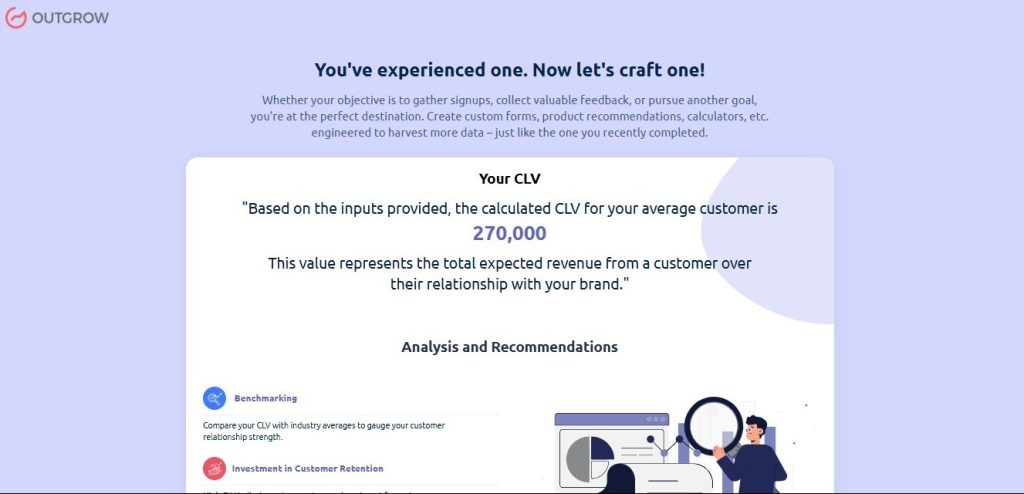

Test the live version here before building yours. Real calculations with actual business numbers.

Four quick questions:

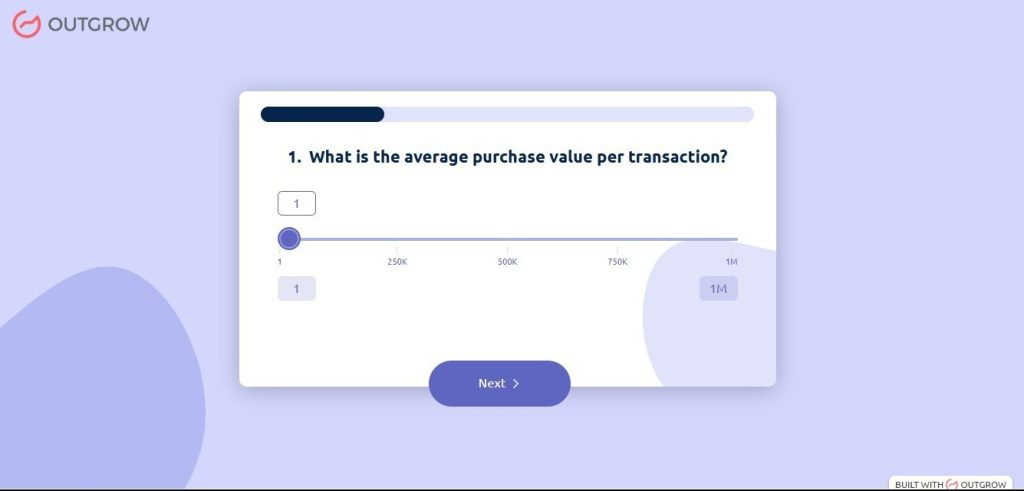

What is the average purchase value per transaction? – Slide $1 to $1 million. Pick a typical transaction size.

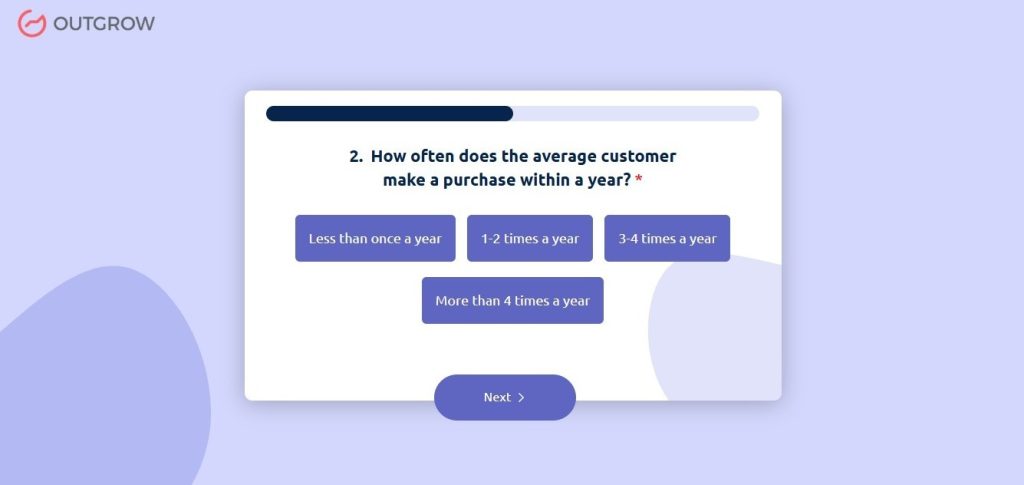

How often does the average customer purchase within a year? – Pick less than once, 1-2 times, 3-4 times, or 4+ times annually.

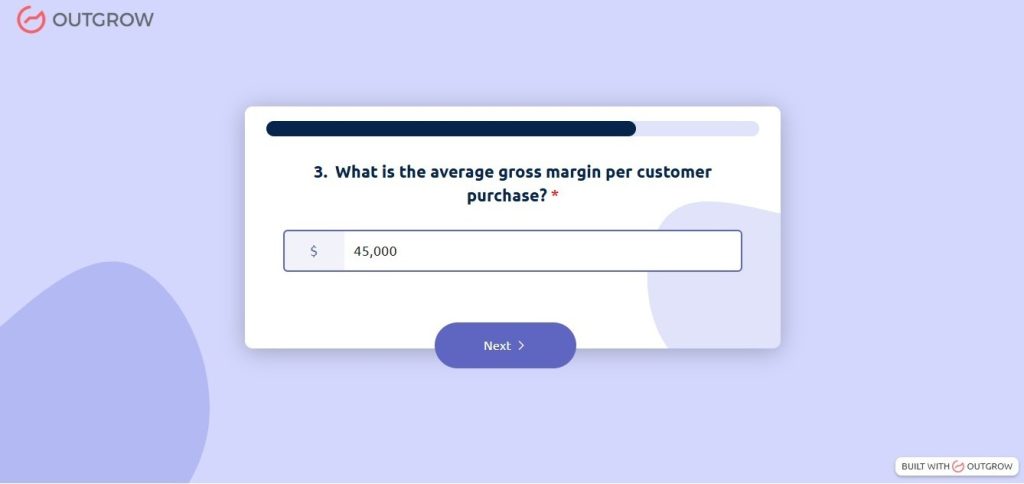

What is the average gross margin per customer purchase? – Enter margin as dollars. Make $30 profit on a $100 sale? That’s your margin.

What is the average customer lifespan in years? – Choose 1-2 years, 3-5 years, 5-10 years, or 10+ years based on how long customers stick.

Under a minute. Answers in, results calculated instantly. Shows customer lifetime value calculator and benchmarking context.

Real scenario: Average purchase $125, customers buying 3 times yearly, $45 margin per purchase, 4-year average lifespan? CLV is $540.

Can’t improve that? Test scenarios. Push purchase frequency to 4 times, watch CLV jump $720. Extend lifespan to 5 years, hit $675. The calculator shows which levers move value fastest.

Why it connects: see the relationship between operational improvements and customer value. 10% retention increase isn’t abstract. It’s $54 more per customer. Multiply by customer count, and strategy priorities are clarified immediately.

Consultants run this with clients in discovery. Marketing agencies use it to justify retention campaign budgets. E-commerce brands test pricing and subscription models. Works because it translates behavior patterns into money.

Lead capture built in. Users drop an email to save results. For businesses selling to companies focused on customer value, perfect lead qualification.

Building Your Own CLV Calculator with Outgrow

Takes 25-35 minutes. Grab the Customer Lifetime Value Calculator Template or hit the calculator builder.

Questions worth asking:

- Average purchase or transaction value

- Annual purchase frequency

- Gross profit margin per purchase

- Average relationship length

- Current retention rate

- Customer acquisition cost

- Discount rate for future value

- Annual growth in purchase value

Math runs itself: Outgrow’s formula builder handles calculations. Reference input fields, the platform computes CLV, annual value, total expected revenue, profitability metrics. Formats everything, zero code.

Design matters: Add comparison charts showing CLV against acquisition cost. Include scenario sliders so users can test retention improvements. Show cohort breakdowns if tracking multiple customer types. People engage with visual feedback more than raw numbers.

Results page essentials:

- Calculated CLV

- Annual customer value

- Total expected revenue

- Payback period on acquisition

- Profitability margin

- Improvement recommendations

- Segment comparisons

Connect systems: Link CRM and marketing automation. Someone finishes the calculator, and contact info flows automatically. Trigger email sequences with retention strategies, upsell content, and loyalty program invites.

Industry Use Cases for CLV Calculators

- E-commerce Brands stick calculators in analytics dashboards. Teams track CLV by traffic source, product category, and customer cohort. Shows which channels bring valuable customers versus one-time buyers.

- SaaS Companies use CLV in their pricing strategy. A product with $450 CLV can’t sustain $50 monthly pricing if acquisition costs hit $180. Calculator forces realistic business models before launch.

- Marketing Agencies deploy CLV tools during audits. Show clients their current customer value, then prove how retention campaigns increase that number. Turns retention from a cost center to a revenue driver.

- Subscription Businesses monitor CLV against churn rates. Monthly tracking shows when initiatives improve value or cohorts decline. Catches problems early enough to fix.

- Retail Stores calculate CLV by location and product line. Downtown location worth $890 versus suburban at $340? Resource allocation and inventory shift accordingly.

Common CLV Calculation Mistakes

- Using revenue instead of margin: CLV based on gross revenue ignores actual profit. Customer spending $2,000 annually at 15% margin is worth $300 yearly, not $2,000. Use margin or overspend on acquisition.

- Ignoring acquisition costs: CLV of $650 looks great until you subtract $580 spent getting that customer. You netted $70 over the years. Track customer acquisition cost alongside CLV, or profitability vanishes.

- Assuming static behavior: Calculating CLV from year-one behavior misses changes. New customers often increase spending year two and three. Or they churn fast. Use actual retention curves, not assumptions.

- Forgetting discount rates: Money five years out isn’t worth today’s dollars. $500 payment in year five is maybe $380 today at 5% discount rate. Long-term CLV calculations need discounting or overstate value.

- Treating all customers identically: Top 20% might have $1,800 CLV, while the bottom 40% sit at $90. The average CLV of $420 hides that spread. Segment calculations or strategy miss reality.

- Never updating the calculation: CLV from 2022 data doesn’t reflect 2026 reality. Recalculate quarterly with current behavior, margins, and retention rates. Old numbers drive bad decisions.

Maximizing Your CLV Calculator’s Impact

- Place calculators where decisions happen: Customer retention strategy posts work perfectly. Pricing strategy pages convert well. Marketing analytics newsletters capture engaged readers.

- Build content around CLV scenarios: “Increase CLV 40% With These Retention Tactics” links to a calculator. “Is Your Acquisition Cost Killing Profitability?” walks through the tool. Drives motivated, qualified traffic.

- Social posts need specific numbers: “Improve retention 6 months and increase CLV from $340 to $460” grabs attention better than vague improvement talk. Link for people testing their numbers.

- Email timing matters: “Calculate Your Q1 Customer Value” sent in January catches the budget planning. Quarterly updates keep businesses tracking CLV changes.

- Partner strategically: CRM platforms link to CLV calculators. Analytics tools integrate value tracking. Business consultants share with clients when evaluating customer strategy.

Reading Your CLV Results

- The lifetime value number is your North Star: What is each customer relationship worth? Guides acquisition spending, retention investment, and customer service levels.

- Annual customer value shows yearly contribution: Useful for comparing against annual retention program costs. Spending $45 yearly to retain a $380 annual value customer makes sense.

- Payback period reveals acquisition timeline: How many months until the acquisition cost is recovered? Three months is healthy. Eighteen months is risky. Longer payback means cash flow problems and higher risk.

- CLV to CAC ratio shows profitability: Industry standard aims for 3:1 or higher. CLV of $900 against $300 acquisition cost hits 3:1. CLV of $450 against $400 cost? Barely profitable.

- Segment comparisons identify opportunities: Email customers showing $720 CLV versus social traffic at $180? Pour resources into email. One segment is worth 4x the other.

Look at the full picture. Low CLV isn’t automatically bad if acquisition costs are tiny. High CLV doesn’t help if acquisition is impossible at scale. Balance all metrics for the real strategy.

Improving Your Customer Lifetime Value

Calculating CLV is step one. Improving it is where money gets made.

- Encourage more frequent purchases: Loyalty programs, subscriptions, frequent discounts, and auto-reorder notifications. Customer buys four times a year instead of once a year? CLV calculation just quadrupled.

- Increase average order value: Product bundling, pricing tiers, upselling, volume discounts. Raising the average order price from $65 to $85 is a 30% boost to CLV.

- Extend customer lifetime: Improve onboarding, proactive support, customer success initiatives, and community engagement. Adding a year to customer retention on a $400 annual value? That’s $400 more per customer.

- Increase gross margins: Process improvements, pricing optimization, cost-cutting, high-margin product lines. Same customer behavior patterns, higher margins – CLV goes up without changing a thing on the customer-facing side.

- Reduce churn: Exit surveys, win-back programs, at-risk customer identification, and removing friction. Every point of churn reduced adds directly to CLV.

- Focus on high-value segments: Move marketing budgets to channels and segments with higher CLV in the past. Stop wasting budget on low-value sources of customers.

Wrapping Up

A customer lifetime value calculator turns customer relationships into actual numbers you can use. Know what customers are worth, how much to spend grabbing them, and where retention investment pays off

A calculator won’t improve CLV for you. That takes strategy and execution. But it kills guessing and shows exactly what each improvement is worth in dollars.

For agencies, SaaS companies, and e-commerce brands, CLV calculators capture leads while helping businesses understand customers. Calculator builder makes custom versions accessible without development teams.

Pick your metrics. Run numbers. Builda customer strategy based on value instead of hunches. Grow profitability by knowing what relationships are actually worth.Sign up for a 7-day free trial today and start tracking the metrics that actually drive profitable growth.

Frequently Asked Questions

A CLV calculator figures out the total profit expected from a customer throughout their relationship with your business. Factors in purchase frequency, average transaction value, gross margins, and how long customers typically stick around. The result shows whether acquisition costs make financial sense.

Accuracy depends entirely on input quality. Use real data from analytics, actual purchase frequencies, true gross margins, and honest retention rates. Calculators project based on historical patterns. Can’t predict market shifts or major business changes, but reliable for planning with current data.

CLV should be at least 3 times the customer acquisition cost. Higher is better. $900 CLV with $200 acquisition cost is healthy. Context matters; subscription businesses often see 5:1 or higher ratios, retail might run closer to 3:1. Compare against your industry and track improvement over time.

Quarterly for most businesses. Monthly, if in high-growth mode or testing major changes. CLV shifts as retention improves, pricing changes, and customer behavior evolve. Regular calculation catches trends before they become problems or opportunities, before competitors spot them.

No. Different customer segments have wildly different values. Email subscribers might show $650 CLV while Instagram traffic sits at $120. New customers behave differently from three-year veterans. Segment by acquisition channel, product line, geography, and customer tier. Strategy decisions need segment-specific data.

Muskan is a Marketing Analyst at Outgrow. She is working on multiple areas of marketing. On her days off though, she loves exploring new cafes, drinking coffee, and catching up with friends.