Summarize with :

How to Build a Financial Investment Calculator?

Table of Contents

Before you continue reading, we’d like you to get a real-time experience of using a financial investment calculator once. Try now!

We think we can all agree on one thing. We all want to retire with deep pockets, or if I put this more bluntly, financial independence is the light we seek at the end of the tunnel.

These buzzwords that we keep hearing – retirement savings, personal finance, return calculator, and investment strategy aren’t just buzzwords, after all. And the road to financial independence is paved with blocks of investment.

Those who talk the most about investment do it the least. Now, for your users who have taken the plunge into the investment waters in a bid to swim towards financial independence, you should do your bit and help them understand the different elements that are needed to hit the magical figure with a calculator. It can show your customers how their initial investment, the frequency of contributions, and risk tolerance can all affect how their money grows. We’ll walk you through how you can create one on Outgrow.

Outgrow allows you to build a wide range of financial investment calculators, risk calculators, savings calculators, and much more with complex formulas and logical statements. Here we’ll go through the steps involved in creating a financial investment calculator.

Financial Investment Calculator – The Magic Formula

Equation 1

S&P 500 dividend yield + about 4.5% = the expected long-term return on stocks

Equation 2

A 1.5% expense ratio = more than 40% of your money after 40 years

Equation 3

Net income/shareholder equity = return on equity

Now that we know the formula, let’s understand how you can create an investment calculator using Outgrow.

Also Check: More details about calculations

Step-by-Step Process to Build an Investment Calculator

Before we begin to tell you all about how to build a financial investment calculator, make a note of all the inputs you’ll need from the users. You’ll need them!

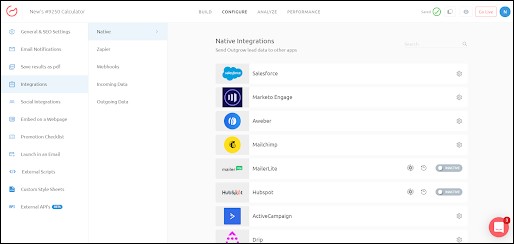

Q1. Starting Balance

Q2. Annual Contribution

Q3. Current Age

Q4. Age of Retirement

Q5. Expected Rate of Return

Q6. Marginal Tax Rate

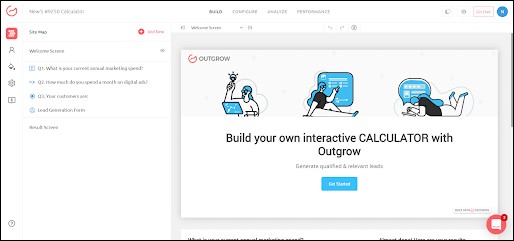

1. Log in to Outgrow Builder. Yep, it’s as easy as it can get. (If you haven’t registered yet, start your free trial here).

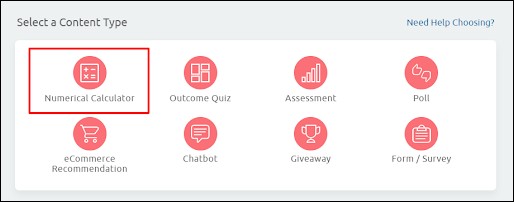

2. Now, choose ‘Numerical Calculator’ as the content type. Come on, that should have been obvious.

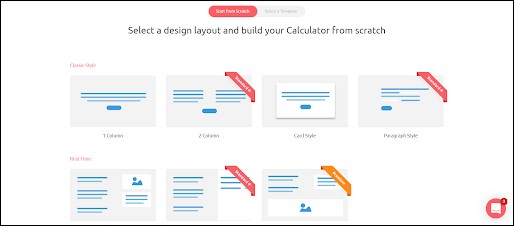

3. Next, you’ll have to pick a layout that suits your needs. For an investment calculator, we recommend you pick one of the real-time layouts that Outgrow has to offer.

4. As with any interactive experience, you need to start off by adding the questions. In the builder, you can add questions by using the text editor on the left panel.

You can choose between different question types such as text inputs, drop-down, multi-select, single select, opinion scale, rating, and numeric slider.

Make sure your questions ask for the right inputs from the users. (Check your notes from before!)

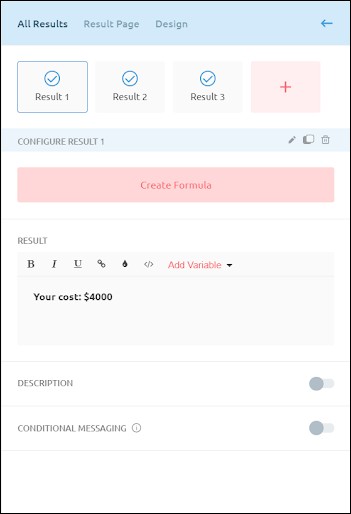

5. Now, it’s time to add the formula to the mix to accomplish the goal of creating this calculator.

The formulae used are as follows:

R1. (Q1*((1+R2)^R3))+((Q2/R2)(((1+R2)^R3)-1)(1+R2))

R2. Q5/100

R3. Q4-Q3

R4. Q2*R3

Here R1 is – At retirement your IRA balance could be worth and R4 is total contributions. R3 and R4 are used just for calculation purposes and their values can also be used directly within the formula.

You can copy and paste this to the formula builder. See it in action in the screenshot below.

Note: You can also use JSON to import formulae into the builder

Investment Calculator – The Magic Lead Magnet

Of course, we are talking about lead generation. By now you know where to position the lead gen form (hint: it is before the results).

Carrying forward from where we left off previously makes your results page rich in value with charts, images, or videos. These additions augment the overall experience and make it well-rounded.

Moving on, you can avail the option of getting an email notification once a user provides his/her contact information. This also works the other way around; you can send an email to your user directing them to more resources once you acquire their contact info.

Now that you have acquired the leads, what next?

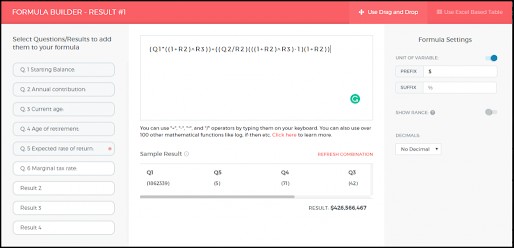

With native and non-native integrations send your leads further down the funnel through pre-established workflows on Zapier, MailChimp et al. For apps without a native integration use web hooks. All these can be accessed here Configure > Integrations.

Some Other Calculators for You to Explore

1. Break Even Calculator

This calculator can be used to determine the sales that one needs to make in order to break even. A breakeven calculator can help in making efficient plans for your business.

2. Affiliate Earnings Calculator

This calculator will help you boost your affiliate partners. You can give them a real-time view of how much they can earn by working with you. Check out an example calculator that we use!

Conclusion

Well, it’s a wrap from our side. You can create a bunch of other cool finance calculators on Outgrow. Just head over to our templates page and find a variety of calculators ranging from retirement savings calculators, personal finance calculators, and credit card payment calculators to VC funding!

You can also explore our promotion checklist to learn about different ways to promote your calculator.

Also Read: 9 Best Practices to Promote Your Calculator

Do you need help creating a complex calculator of your own? Hit us up with the red chat button on the bottom right. Or start by taking our course on how to boost lead generation using calculators.