Summarize with :

How to Build a Retirement Calculator?

When House Speaker Paul Ryan decided to retire to spend more time with his children, it came with some upshot. And every retirement is more or less the same – it comes with some consequences. Probably this is why people like to plan in advance, to be in control of situation when they retire.

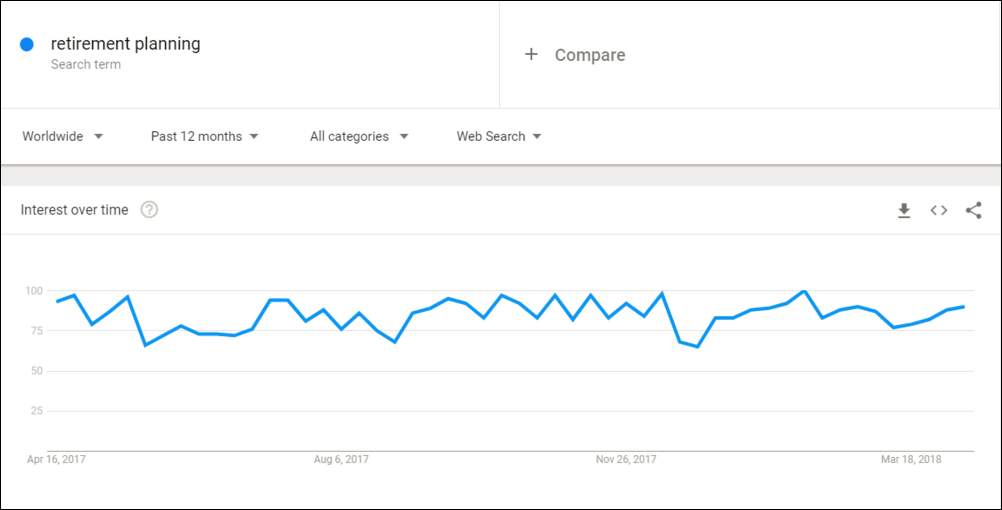

People are constantly on the lookout for retirement planning solutions (Google Trends affirms that).

And for companies in the finance sector, answering these concerns could prove to be a gold mine of business opportunities.

Customers today want to be helped, and not sold to. Thus, creating assets that help them and at the same time get you business, is the way to go about. One such asset is a calculator. When you create a calculator, you give people real-time solutions to their questions and provide instant gratification. This results in people instilling their faith in your business. What’s more – a calculator also gets you 12X more leads when compared to other sales and marketing assets like blog posts, white papers etc. Do you need more reasons to build a calculator?

Let’s get you started, then, with the step-by-step process of creating a retirement calculator.

Retirement math is pretty simple. To begin with, get the formula right by focusing on earning, saving, and investing to hit financial independence.

There is no 100% correct formula for retirement savings but you can focus on the points mentioned below to create your own retirement formula. The calculation isn’t exact, but it’ll give you a rough estimate of what you’ll need to save. You’ll need to go through the following:

- Calculate 80% of the current salary

- Factor in inflation by typing in 1.03^(number of years until a person retires).

- Multiply #1 by #2. This is what the salary will look like in the future with normal inflation.

- Subtract what you’ll receive from Social Security (this is on a person’s Social Security Statement) from the number you got in #3.

- Multiply the final number from #4 by 20. This is the amount of a person will need to save for retirement.

Pro Tip: You can find more details about the calculations here.

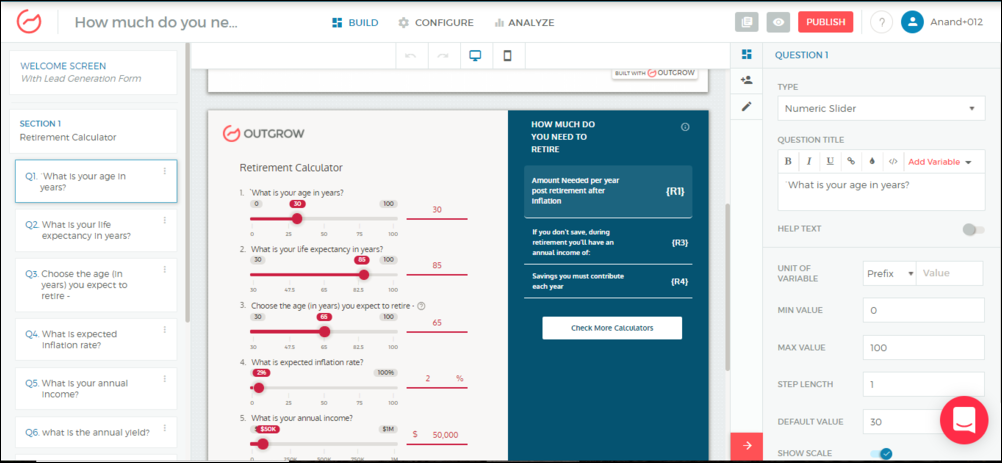

Now that the formula is ready, let’s look at the information you’d need from the users. You’ll need the following inputs –

- Q1 – Your current age

- Q2 – Your life expectancy

- Q3 – Your retirement age

- Q4 – Expected Inflation rate

- Q5 – Annual Income

- Q6 – Annual Yield

- Q7 – Amount needed during retirement

- Q8 – Current Savings

You can also skip taking a few inputs such as inflation rate, yield, the amount needed during retirement and can add them as assumptions. However, these values may vary from country to country and it is always a good idea to take the inputs.

1. Add all the questions as required and edit the desired changes on the right side

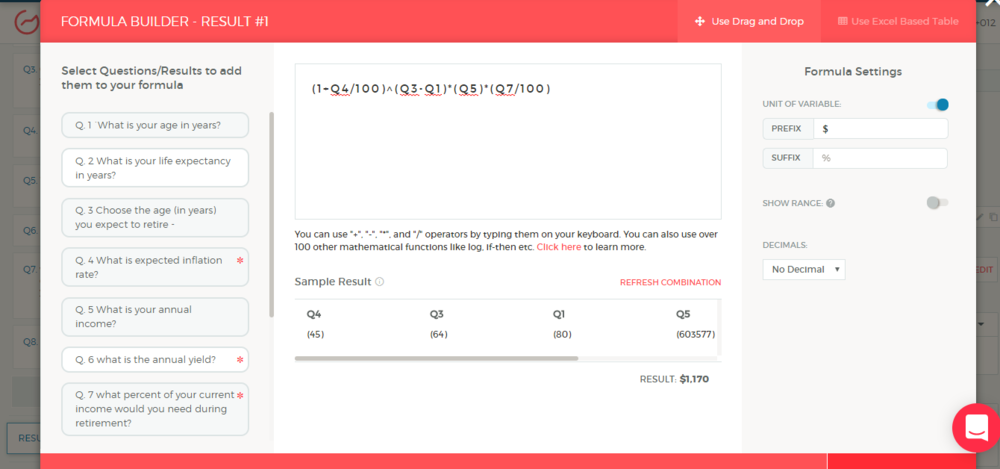

2. Now, add formula the formula we created earlier in the formula builder.

The formula for amount needed post-retirement is – (1+Q4/100)^(Q3-Q1)*(Q5)*(Q7/100)

Here we have divided the Q4 – inflation and Q7 – percentage of savings by hundred because we are capturing these inputs in % form

In the formula builder –

- Add prefix and suffix as required. In this example, we have added ‘$’ as a prefix.

- You can also add decimal places as required

- You can quickly validate the formula if the sample result displayed is correct.

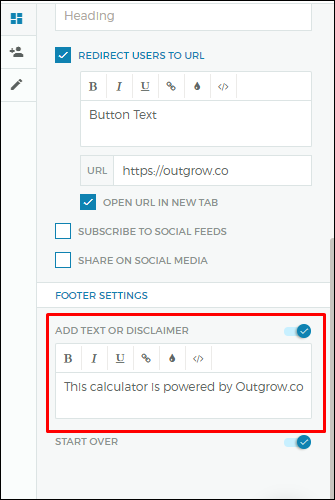

3. Next, set up your results page. This is the most important part of your calculator, as it is the results that your prospects are looking forward to. Since this is a numerical calculator, you can go easy on the creativity, and include simple yet clear copy. However, don’t forget to include a disclaimer about the estimation of results. You can add this from the results properties on the right panel.

Related Read: 8 Ways to Get More Out of Your Results Pages

4. Last but not the least – add a lead form. After all, you’d want to generate some business out of this calculator, won’t you? In case you’re wondering how you can optimize your calculator for lead generation, we’ve got you covered. This post highlights practices you can follow to create more effective lead magnets.

We hope we could define the process for you clearly. In case you want to see a retirement calculator in action, check out this mortgage calculator below –

Start building your first retirement calculator now. Sign up for a free Outgrow trial. If you still have issues creating this or have no time to build it yourself, we have an awesome customer success team that can help you. For more details on custom plans, drop us a message by clicking on the chat icon on the bottom right.