Summarize with :

How to Build a Life Insurance Calculator?

Table of Contents

Life insurance is a topic that evokes mixed feelings. Different people hold different opinions regarding this – youngsters find it unnecessary whereas elders feel it’s a saving worth a lifetime. It’s hard to arrive at a conclusion, but it’s safe to say that life insurance is advisable to maintain, given the uncertainty of life. Upheavals are unannounced and it is better to be prepared than pitied.

Calculating the amount required to meet unforeseen expenses needn’t be mind-numbingly long and difficult. With an Outgrow life insurance calculator, the whole thing can be done in a jiffy.

In this post, we walk you through the various steps involved to get your life insurance calculator up and running in a matter of minutes. Follow along as we try to make life easier for you one calculator at a time.

When purchasing life insurance, the question really isn’t how much you need, but how much capital your family will need post going to rest (God forbid!). And this depends on two variables:

How much will be needed at the end to meet immediate obligations?

This amount takes into account all final expenses: uncovered medical bills, funeral and estate-settling costs, outstanding debts, mortgage balance and college costs to name a few.

How much future income is needed to sustain the household?

This is the number you’ll arrive at after calculating the “present value” of cash-flow streams your family will need after your death.

Now that we know all about the calculations, let’s understand how you can create a life insurance calculator using Outgrow.

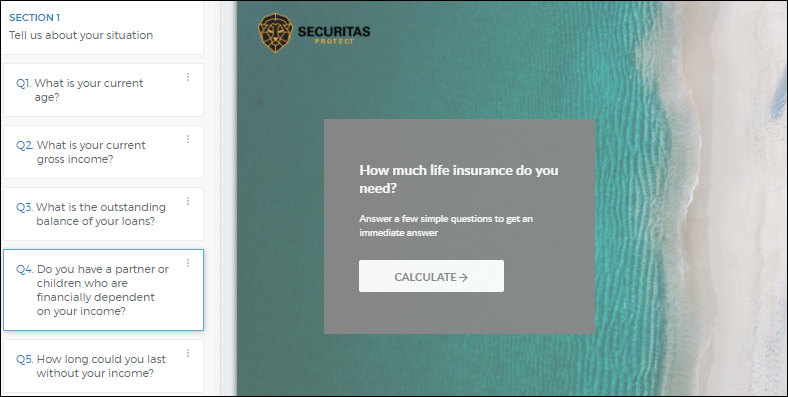

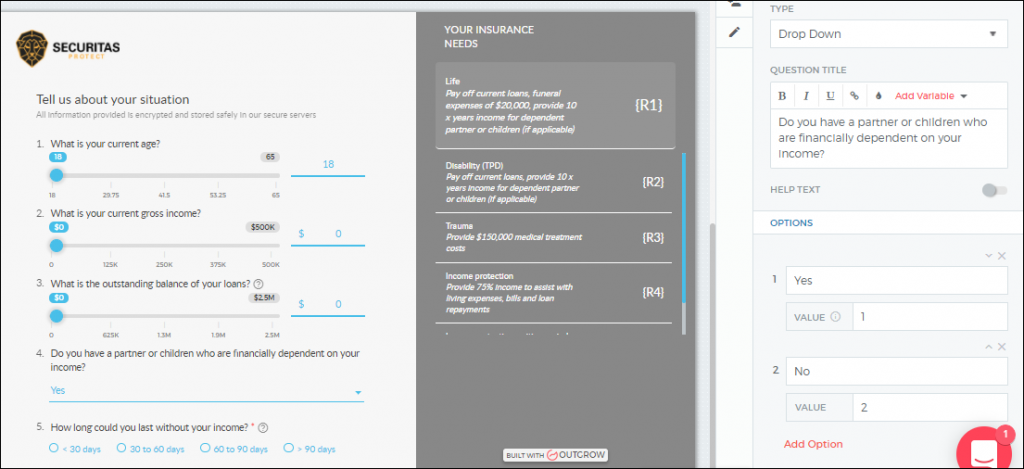

As for any calculator, start by getting the input data for your calculator from the users

Q1. Your current age

Q2. Your gross income

Q3. Your loan repayments

Q4. Family Information

Q5. Current Savings

1. Add all the questions as required and edit the desired changes on the right side

Pro Tip: Avoid asking too many questions. A count of 7 to 8 questions is optimum. Learn more about creating high-converting calculators.

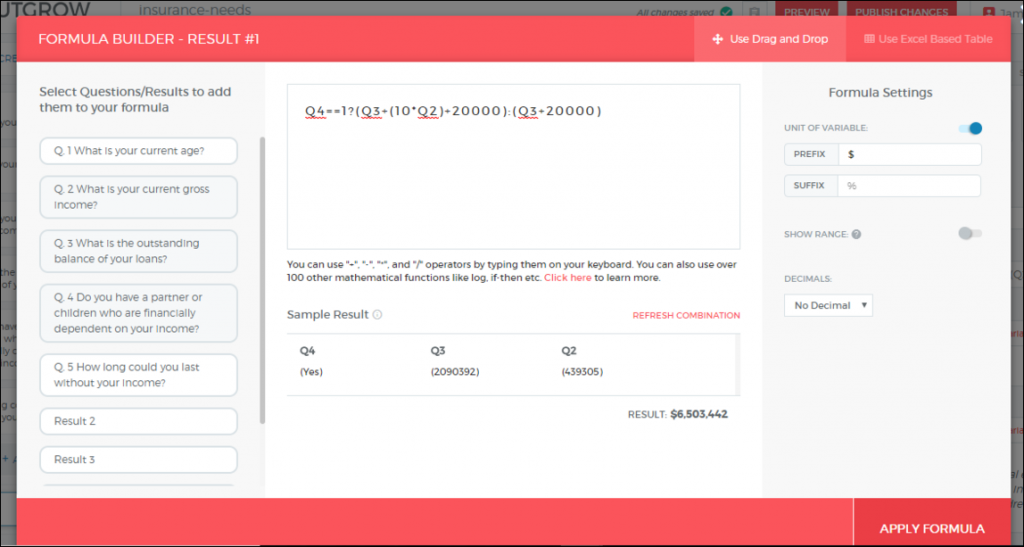

2. Now add the formula in the formula builder.

Formula for life insurance is – (Q4==1?(Q3+(10*Q2)+20000):(Q3+20000))

Here we have used if else conditions based on family information

In the formula builder:-

- Add prefix and suffix as required. In this example, we have added ‘$’ as a prefix.

- You can also add decimal places as required.

- You can quickly validate the formula if the sample result displayed is correct.

Once your calculator is up and ready, it is time to make it useful.

Lead Generation

An insurance calculator is a tool of great utility and will be used by many, which means it can generate LOL (lots of leads). To ensure that you’re ready to capture leads using the calculator, you need to create a stellar results page. Stick to positive, succinct copy. Make the page rich by using graphs and tables, which break up the numerical data in the results. And, of course, don’t forget to add a lead form. You can do so by clicking on the ‘Lead Generation’ tab at the bottom of the left sidebar in the editor.

Once you have acquired leads it’s time for the next step. You can embed the calculator on your website, post it on social media or even share it with a friend via email.

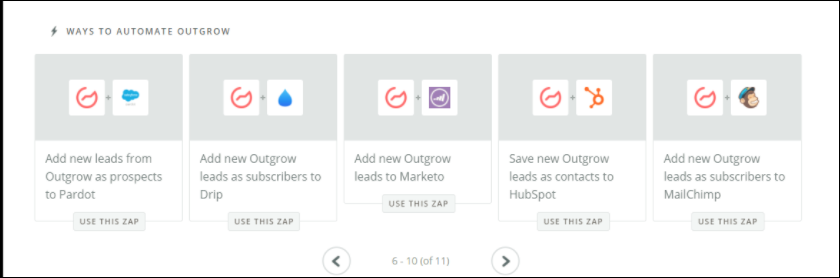

Leverage Integrations

Outgrow has native integrations with 1000 apps and counting. This means you can run your leads through custom workflows which will lead them further down the funnel.

We hope our guide to building a life insurance calculator provided you with enough clarity. You can see a life insurance calculator in action below:–

![How to Embed a Quiz on Your Website? [10+ Ways]](https://outgrow.co/blog/wp-content/uploads/2021/11/How-to-Embed-a-Quiz-on-Your-Website.jpg)

One Comment